The internal conflict within the Sapura Group has intensified following developments in the lawsuit between Tan Sri Shahril Shamsuddin and his younger brother, Dato’ Shahriman Shamsuddin.

On May 8, media reports revealed that Tan Sri Dato’ Seri Shahril Shamsuddin, the former Chairman of Sapura Energy Berhad (SEB), is under investigation by the Malaysian Anti-Corruption Commission (MACC) over suspected money laundering involving over RM500 million worth of Sapura Energy shares.

This ongoing saga traces back to investments following the merger of Sapura Kencana Petroleum Berhad (SKPB) and Sapuracrest Petroleum Berhad, which later became Sapura Energy. If Sapura Kencana is indeed involved, it could potentially implicate Tan Sri Mokhzani Tun Mahathir, whose company Khasera Baru Ltd sold 190.3 million shares in SapKen for a gain of RM820 million.

According to MACC, the investigation focuses on Section 23 of the MACC Act 2009, particularly regarding the issuance of remuneration (salary, bonuses, shares), “branding fees,” and private placements between 2012 and 2021.

Although this issue was previously raised by Rafizi Ramli and defended by then Prime Minister Najib Tun Razak, it had been explained that Shahril’s high salary was largely tied to a share covenant agreement with 14 financial institutions when Sapura Energy refinanced RM14 billion worth of loans in 2014. His salary was also approved by the Board of Directors.

That agreement required Shahril to maintain at least a 10% equity stake and remain CEO. If he resigned or his holdings fell below that threshold, the company risked loan defaults.

Abuse of Power: Why Hasn’t MACC Investigated Dato’ Shahriman Shamsuddin?

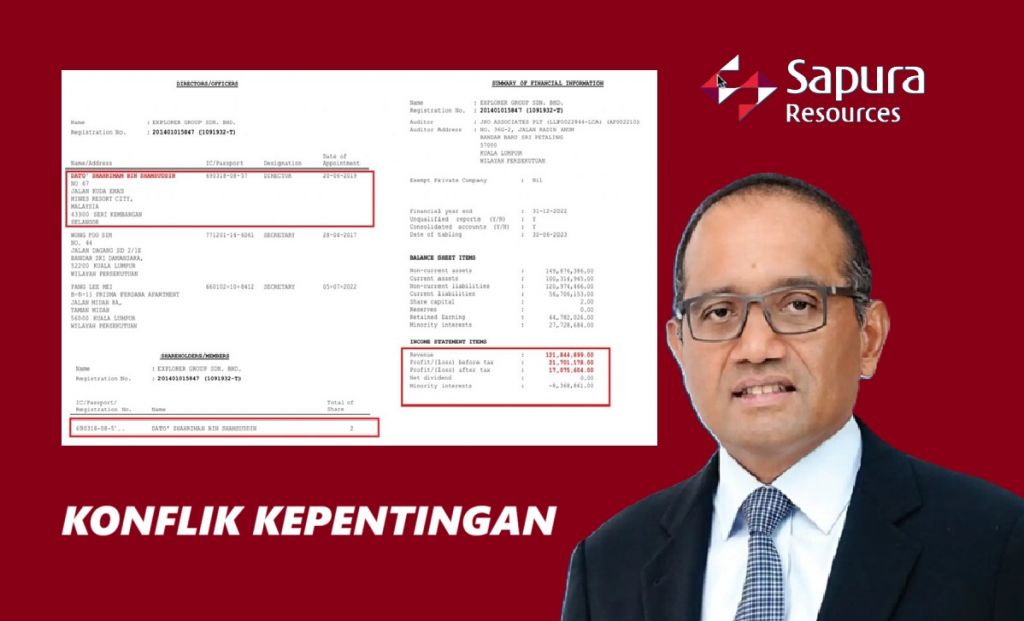

The Corporate Secret previously exposed serious allegations of conflict of interest, abuse of power, and financial mismanagement involving Dato’ Shahriman Shamsuddin, who resigned as Managing Director of Sapura Resources Berhad on 30 October 2024.

Article 1: Abuse of Power and Financial Misconduct by Dato’ Shahriman May Cost 6,000 Jobs in the Sapura Group — 10 November 2024

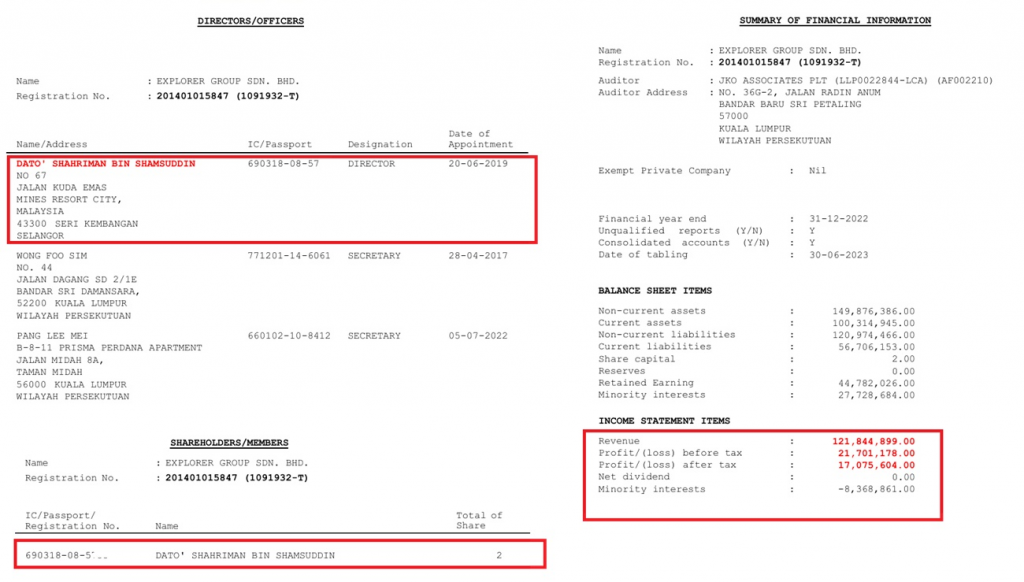

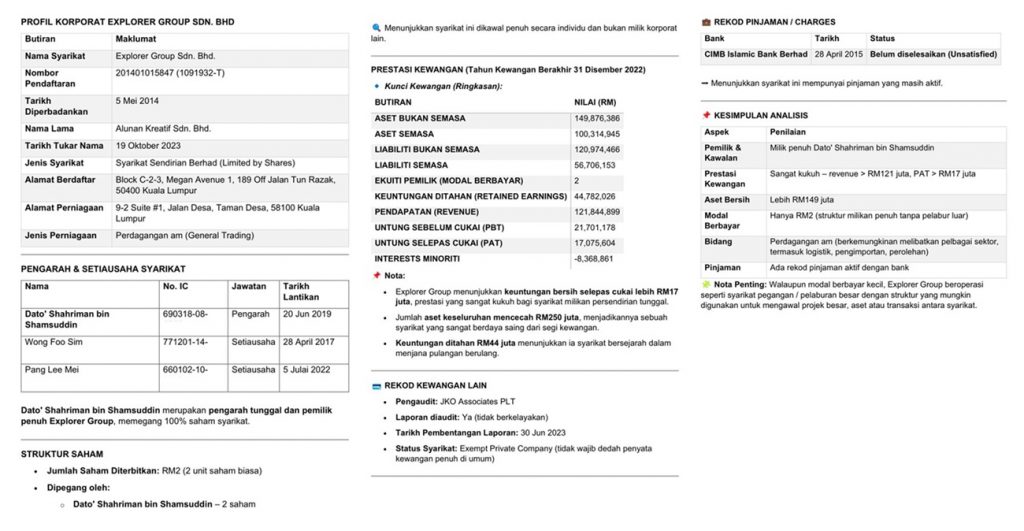

In July 2023, Sapura Resources Berhad (SAPRES) decided to exit its Maintenance, Repair, and Overhaul (MRO) division. Its aviation unit was slated to be sold to RoyalJet, a luxury private jet operator based in Abu Dhabi. However, the agreement was not executed with Sapura Resources’ subsidiary, but with Explorer Group Sdn Bhd — a company owned by Dato’ Shahriman himself, who was also then Managing Director of Sapura.

This move was widely viewed as a blatant conflict of interest and an attempt to unlawfully siphon commercial value from Sapura into his private entity, potentially depriving Sapura of substantial profits.

Even more troubling, Dato’ Shahriman allegedly misled a royal entourage, including the former Yang di-Pertuan Agong and the MITI Minister, during an official visit to the UAE, creating the illusion that business dealings with RoyalJet were through Sapura, when in fact they were routed through his personal company.

Additionally, SAPRES’ board raised concerns about Shahriman’s decision to appoint an unqualified female personal assistant with a high salary — not to Sapura, but to work for Explorer Group, further intensifying the conflict of interest.

Article 2: Conflict of Interest — Police and SSM Reports Filed Against Former MD Dato’ Shahriman Shamsuddin — 11 March 2025

All available evidence and documentation point to Dato’ Shahriman’s involvement in multiple serious allegations including financial misappropriation, abuse of authority, and breach of fiduciary duties during his tenure as MD of Sapura Resources Berhad.

This prompted Sapura Resources to lodge a police report and file a formal complaint with the Companies Commission of Malaysia (SSM), citing clear violations of the Companies Act 2016 and manipulations concerning company asset management and ownership by Dato’ Shahriman.

What Have Authorities Done?

Despite reports lodged with the police, SSM, and the Securities Commission, no action has been taken. Since MACC has commenced investigations into Tan Sri Shahril, it is only logical and just that Dato’ Shahriman — whose alleged offences mirror those of his brother — should be investigated as well.

The Sapura Holdings Dissolution Petition

On 23 September 2024, Dato’ Shahriman filed a petition to dissolve Sapura Holdings — the family’s investment vehicle — in retaliation against the probe and his suspension from Sapura Resources. This act further endangered the livelihood of over 6,000 Sapura employees.

During the winding-up hearing on 15 May, the court ordered the public gallery cleared of all non-essential attendees, including media. Only a few selected individuals were allowed to remain. The hearing continues on 21 May, with the gallery expected to reopen once cross-examination of Tan Sri Shamsuddin concludes.

Currently, both Shahril and Shahriman own 40.5% direct stakes in Sapura Holdings, while their jointly-owned entity, Brothers Capital Sdn Bhd, holds 15%. The remaining 4% is owned by Datuk Rameli.

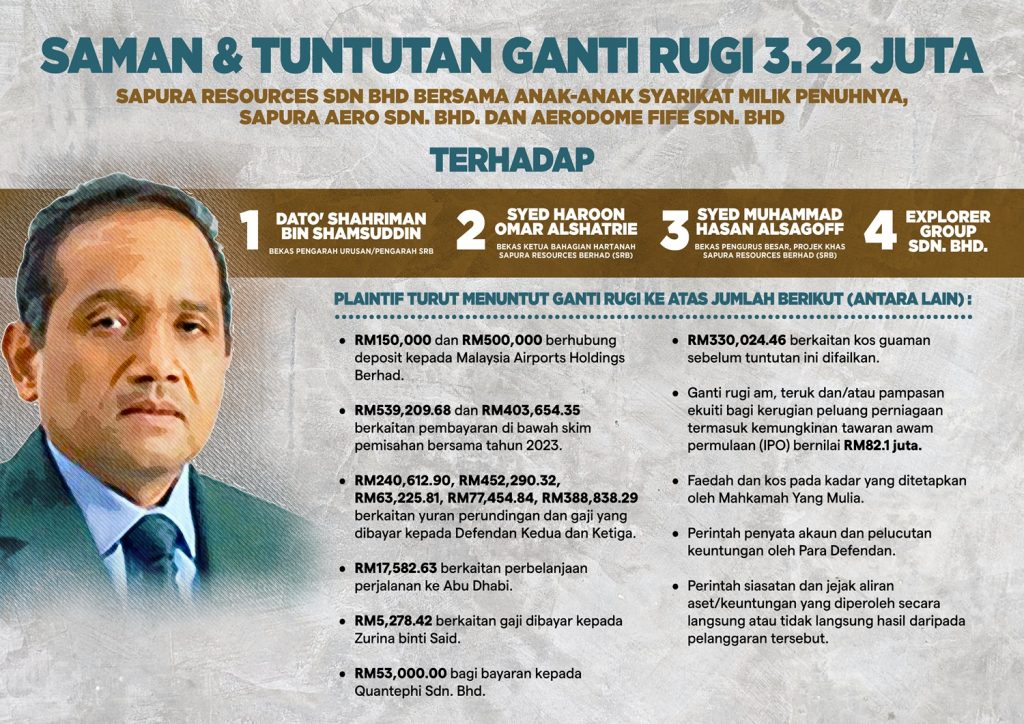

Sapura Resources Sues Dato’ Shahriman for RM3.22 Million

Citing gross misconduct and breach of fiduciary duty, Sapura Resources Bhd and its subsidiaries — Sapura Aero Sdn Bhd and Aerodome Fife Sdn Bhd — filed a lawsuit against Dato’ Shahriman and his associates: Syed Haroon Omar Alshatrie, Syed Muhammad Hasan Alsagoff, and Explorer Group Sdn Bhd.

Filed in the Kuala Lumpur High Court, the suit seeks RM3.22 million in damages over financial mismanagement, excessive consultancy fees, improper severance payouts, and operational expenses — including misuse of funds linked to Malaysia Airports Holdings Bhd and a voluntary separation scheme.

Sapura Resources also claims it suffered substantial business losses, including the forfeiture of an RM82.1 million initial public offering (IPO) opportunity.

Who Are Syed Haroon and Syed Muhammad?

Why were Syed Haroon bin Omar Alshatrie (son of Dr. Syed Omar Al Shatrie) and Syed Muhammad bin Hasan Alsagoff paid such high salaries despite working primarily for Dato’ Shahriman’s private firm, Explorer Group, even though their pay came from Sapura Resources?

Dato’ Shahriman is known to be deeply influenced by Habib Dr. Syed Omar Alshatrie, a respected religious figure in Malaysia’s Hadrami community. Shahriman reportedly paid Dr. Syed Omar RM70,000 a month while also employing his son, Syed Haroon.

Syed Haroon was appointed Head of Property at Sapura Resources, overseeing key projects such as Permata Sapura. Syed Muhammad, formerly GM of Operations, had previous stints at Sapura Secured Technologies and GE Oil & Gas. Both are named in Sapura Resources’ lawsuit.

Who Is the Puppet Master Behind Dato’ Shahriman?

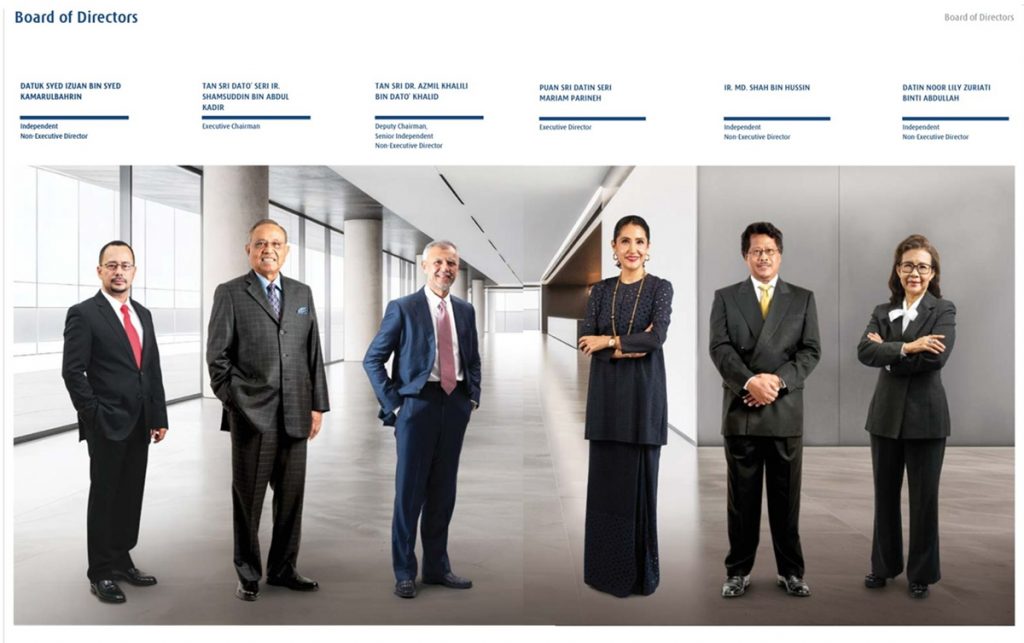

Sources suggest that the true mastermind behind Dato’ Shahriman is Tan Sri Shamsuddin’s new wife, Puan Sri Mariam Parineh, an Iranian national. Originally a close friend of Shahriman — she assisted him in adopting a child from Iran — Mariam eventually married his father, Tan Sri Shamsuddin.

After their marriage in 2012, Tan Sri Shamsuddin sued his own sons, Shahril and Shahriman, to reclaim RM450 million worth of assets that had been gifted to them following the death of their mother, Puan Sri Siti Sapura Husin. The dispute was later settled out of court.

On 26 July 2022, Tan Sri Shamsuddin transferred all of his shares in Sapura Industrial Berhad to Puan Sri Mariam, who now sits on the company’s board and effectively controls it. She is reportedly working to erase the old legacy and rebuild a new one — under her terms.

Insiders claim the entire plan to dissolve the Sapura Group, including the proposed fire sale of the 52-storey RM1.3 billion Permata Sapura Tower, is her brainchild — orchestrated with Dato’ Shahriman.

MACC Must Investigate

The abuse of power and blatant financial misconduct by Dato’ Shahriman through his private entity, Explorer Group Sdn Bhd, is undeniable. It is time for the MACC to act decisively — and place Dato’ Shahriman under investigation.