The Malaysian businessman is seeking to overturn his conviction in Singapore for 177 securities offences for which he was sentenced to 35 years in jail.

Jailed Malaysian businessman Soh Chee Wen will go to the Court of Appeal in March seeking to overturn his conviction on 177 charges for multiple securities offences three years ago in a landmark trial which ran for almost 200 days.

Soh, 65, is already serving a 36-year sentence in Changi prison following his conviction on 180 charges brought against him involving the trade of Blumont, Asiasons and Liongold shares on the Singapore Exchange (SGX).

“The learned judge took the defence to task for stating that the prosecution took a blinkered view.

“The appellant (Soh) maintains and reiterates that the prosecution had indeed taken a blinkered view,” Soh’s lawyers said in a 406-page submission dated Jan 17, arguing that the convictions were unsustainable and unsafe.

In particular, they contend that High Court judge Hoo Sheau Peng had failed to analyse crucial evidence, instead relying on a flawed “broad-brush” approach to the case by agglomerating 189 trading accounts on the assumption that Soh controlled all of them.

“The broad brush used by the prosecution, and accepted by the learned judge, meant that the role the appellant played was not scrutinised in any granular manner, in terms of the actual trade orders given or trades carried out.

“Rather, everything was lumped together, and general impressionistic conclusions were drawn,” the filing read.

Soh’s lawyers also contends that the High Court judge ignored clear and contradictory evidence given by several key prosecution witnesses in coming to her decision.

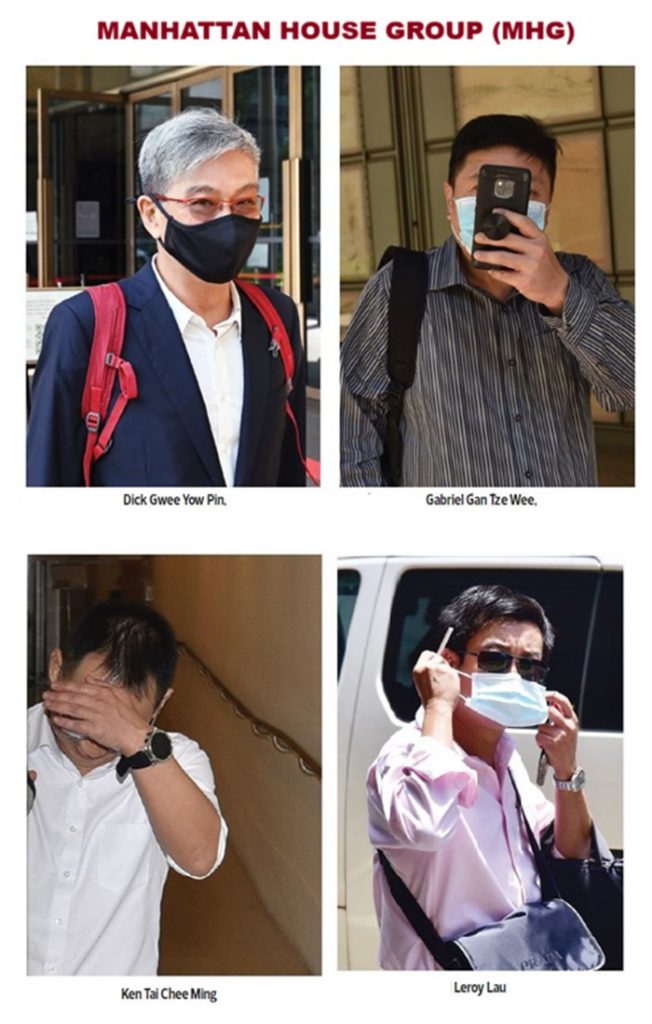

They claim that Dick Gwee, who became a central figure as the trial unfolded, was not even on the prosecution’s original witness list.

“The role of Gwee, whom the investigating officer (from the Commercial Affairs Department) said had made profits of S$50 million from trading in (the) shares, was not even mentioned in the prosecution’s lengthy and seemingly comprehensive opening address.

“Key witnesses lied about their involvement in manipulation while on the stand and admitted to doing so to avoid implicating Gwee.

“In the light of the evidence that the defence managed to dig out, this omission is shocking and shows either a very incomplete investigation or a simple refusal to look elsewhere than at the appellant and (co-appellant Quah Su Ling),” the submissions read.

They claim Gwee was a primary market manipulator and had along with other key players — Ken Tai, Henry Tjoa, Gabriel Gan and Leroy Lau — traded independently.

“As the trial went on … it emerged that Gwee and his associates were involved in a ‘pump-and-dump scheme’. This was entirely inconsistent with, and indeed opposed to, the appellant’s hopes of rebuilding a corporate empire.

“The manipulative trades were done by Gwee and his associates and it was some of the relevant accounts that were bearing the adverse consequences,” the submissions read.

“Eventually, the prosecution had no choice but to call Gwee as their witness.”

The appellant’s solicitors also contend that the analysis conducted by the prosecution’s market expert, Professor Michael Aitken, was flawed.

“Aitken was given a list of accounts to examine. He was told to assume that all the accounts in the list were controlled by the same party.

“This meant that his analysis was not being used to discover where allegedly manipulative trades took place but to confirm that the trades in these accounts were manipulative, on the assumption that they were controlled by the same party,” the submissions read.

The submissions also challenged the prosecution’s reliance on reports issued by the Government Technology Agency of Singapore (GovTech) to prove control.

“The GovTech report mapped out calls and messages where at least one of the numbers involved was a mobile number that was connected to the appellants (Soh and Quah) or to a trader.

“The prosecution’s approach was to link the time of such communications to a trade and in turn ask that it be inferred that the communication was an instruction to trade,” the submissions read.

However, the solicitors contend that the evidence lacked probative value.

“Save for WhatsApp messages, the contents of the calls and SMSes are not known. It could be instructions, it could be requests for tips or information or it could be wholly unconnected to trades.

“The defence has adduced a typical example in the communication between Quah and See Kheng Lim – a lunch appointment somehow was used to garner a hit against a trade,” the submissions noted.

Soh’s appeal will be heard on March 3 and 4.

He was arrested on Nov 24, 2016.

On May 5, 2022, Soh and Quah were found guilty of masterminding a penny stock crash on the SGX nine years earlier through a criminal conspiracy involving forced trading, share price manipulation and deception.

Quah was sentenced to a 20-year jail term after being found guilty in 169 of the 178 charges she faced.

1 thought on “Soh Chee Wen’s Fight: ‘Blinkered Prosecution’ at Heart of Appeal”