The widening investigation into the MBI financial scheme continues to rattle Malaysia’s corporate landscape. Following disclosures linked to Alex Ooi, authorities had earlier detained Lee Hock Seng, chairman of Magma Group Berhad, and Low Eng Hock, CEO of Ivory Properties Group Berhad.

Now, two more high-profile figures have reportedly been taken into custody — Lee Foo San of Watta Holding Berhad and Goh Choon Lye, who is linked to ACME Holdings Berhad and MGB Berhad.

Investigation Enters a More Serious Phase

The latest detentions signal that investigators may be moving beyond the scheme’s founders and into a broader network of business figures and listed companies allegedly involved in channeling funds.

Sources familiar with the probe suggest the case is expanding rapidly, raising fresh questions about how illicit capital may have flowed through corporate structures before being reinvested into large-scale property developments.

Who Are They?

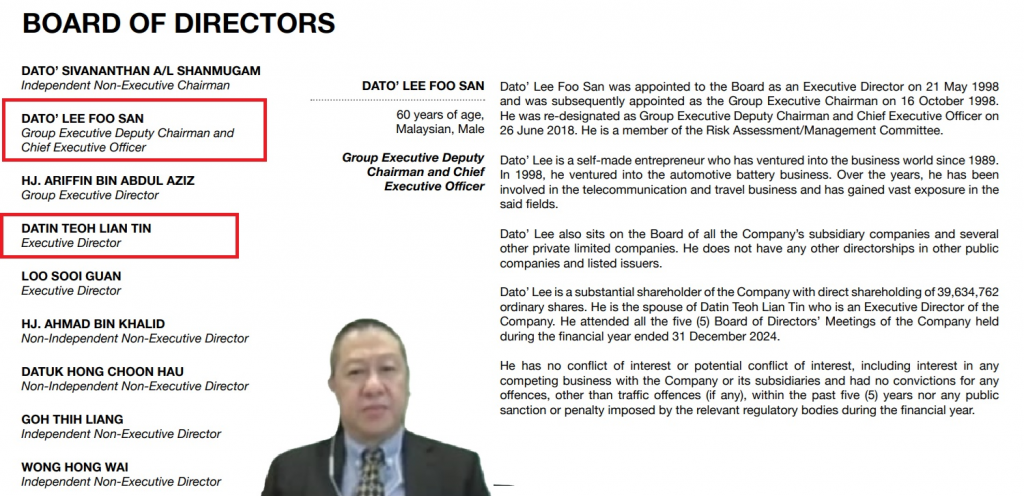

Dato’ Lee Foo San — Watta Holding Berhad

Dato’ Lee Foo San serves as Deputy Executive Chairman and Group Chief Executive Officer of Watta Holding Berhad. Having been active in business since 1989, he previously held the dual role of Executive Chairman and CEO.

Under his leadership, Watta diversified across several sectors, including automotive batteries, telecommunications, energy, and tourism services.

His detention has surprised market observers. Watta was widely regarded as a conservative corporate player, yet its name has now surfaced in connection with alleged MBI fund flows.

Goh Choon Lye — ACME Holdings & MGB Berhad

Penang-based businessman Goh Choon Lye has drawn attention due to his involvement with two notable public-listed companies.

At ACME Holdings Berhad, Goh — through his investment vehicle WWT Wellness Solutions Sdn. Bhd. — was reported to hold an indirect stake of approximately 9.99% as of September 23, 2024. ACME operates across property development, furniture manufacturing, and strategic investments.

He was also previously linked to a substantial indirect shareholding exceeding 30% in MGB Berhad, a construction-focused company now under LBS Bina Group Berhad, which is active in affordable housing and infrastructure projects.

Political and Business Links Under Scrutiny

Market talk has long pointed to Goh’s close ties with influential political and corporate personalities, including gambling tycoon Tan Kok Ping, a former president of the Penang Chinese Chamber of Commerce.

Tan, the Executive Chairman of Magni-Tech Industries Berhad, has previously faced investigations involving alleged tax evasion, illegal gambling activities, ownership of entertainment outlets, and purported bribery payments. Despite past scrutiny, he has been viewed as a resilient corporate figure.

While these associations do not establish wrongdoing, investigators are believed to be mapping corporate relationships as part of a broader financial trail.

Expanding Web of Corporate Connections

LBS Bina Group — controlled by Lim Hock San — had previously entered into a Heads of Agreement with Nylex (Malaysia) Berhad, a troubled firm that was delisted from Bursa Malaysia earlier this year.

Nylex, together with Ancom Nylex Berhad, has been associated with media entrepreneur Siew Ka Wei, who was previously linked to the RM99.963 million “Speedy Gonzales” controversy during his tenure as chairman of Tourism Malaysia. He was reportedly remanded by the Malaysian Anti-Corruption Commission (MACC) alongside a corporate associate.

More Big Names in the MBI Dragnet

Investigative sources indicate that the arrests of Lee Foo San and Goh Choon Lye followed the emergence of fresh evidence suggesting that MBI-related funds were routed through listed-company networks before being recycled into property ventures.

With the addition of these two names, the number of high-profile corporate figures now under the radar of investigations continues to grow, including Dato’ Sri Lee Hock Seng of Magma Group Berhad and Dato’ Low Eng Hock of Ivory Properties Group Berhad.

Corporate Fallout Could Be Significant

The latest developments reinforce a growing perception within financial circles: the MBI scheme may have penetrated far deeper than previously believed — reaching boardroom level and major shareholders of Bursa-listed firms.

Authorities are examining whether funds linked to alleged mastermind Teddy Teow were laundered through public companies — a scenario that, if proven in court, could place the scandal among Malaysia’s most consequential financial cases since the 1MDB scandal.

The case potentially combines elements of illegal investment activity, misuse of public-listed entities, and possible political proxy networks.

A Turning Point for Victims — Yet Questions Remain

For investors and members of the public who suffered losses under the MBI scheme, the latest enforcement actions suggest authorities are tightening the net around both key operators and their alleged corporate channels.

However, one unresolved mystery continues to circulate in market circles — a reported RM10 million funding transaction allegedly involving Chiau Beng Teik of Chin Hin Group Berhad and Tan Kean Soon of T7 Global Berhad.