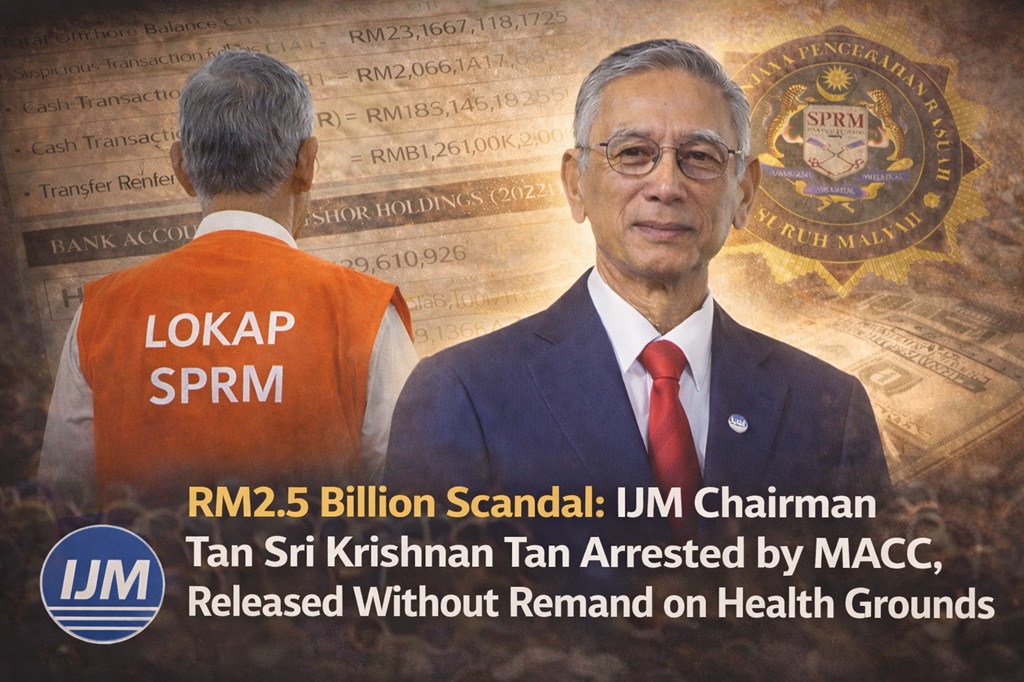

PUTRAJAYA — The arrest of IJM Corporation Berhad chairman Tan Sri Krishnan Tan by the Malaysian Anti-Corruption Commission (MACC) is more than a routine investigative development. It could mark the beginning of a confidence crisis surrounding the leadership of a conglomerate long regarded by investors as stable.

Krishnan Tan, 74, was detained at approximately 7pm on Thursday at the MACC headquarters in Putrajaya after authorities conducted raids on multiple premises, including his residence. In a development that surprised many observers, however, he was not remanded and was released after about 24 hours due to health concerns.

While the release complies with procedural requirements, questions are now circulating among market watchers as to whether health considerations are increasingly becoming a protective shield for high-profile corporate figures facing enforcement action.

A RM2.5 Billion Investigation

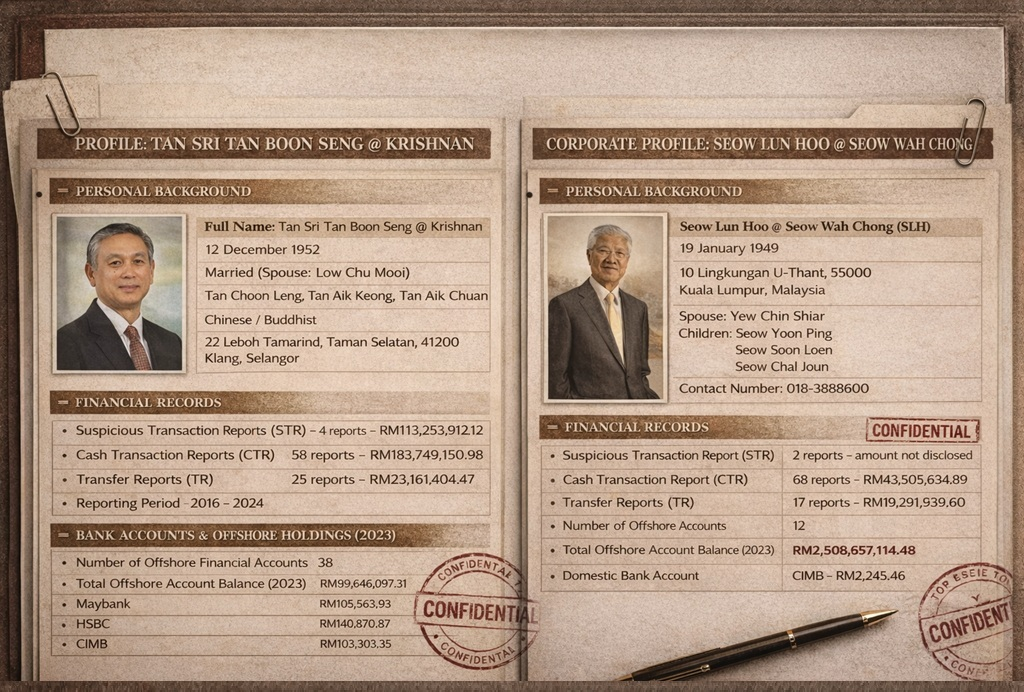

According to sources, the probe focuses on several serious matters, including corporate governance practices, procurement processes, complex financial transactions, and overseas asset ownership estimated at a combined value of RM2.5 billion. The investigation is also linked to his alleged proxy, Seow Lun Hoo — also known as Seow Wah Chong — the founder of investment firm Newfields Group.

A figure of this magnitude is rarely associated with the chairman of a listed company, positioning the case among the most closely watched in Malaysia’s corporate landscape.

MACC’s Special Operations Division has reportedly widened the investigation with additional searches at several locations, including the offices of Newfields Group, an investment bank, and residences connected to the suspects. Preliminary inquiries are also believed to examine the role of an investment bank appointed to manage an acquisition offer related to IJM, suggesting the probe may extend into strategic corporate layers rather than isolated transactions.

At the same time, the MACC has frozen 70 bank accounts — comprising both personal and corporate accounts — involving approximately RM30.6 million. More than 10 senior IJM management officers are understood to have been affected by the freeze. Authorities are also actively tracing other assets suspected of links to money laundering activities.

To date, at least 15 witnesses have been called in to provide statements, including the chairman’s spouse.

MACC Special Operations Division senior director Datuk Mohamad Zamri Zainul Abidin confirmed the arrest, stating that the investigation is being conducted under Section 16 of the MACC Act 2009 and Section 4(1) of the Anti-Money Laundering Act. He also confirmed that the suspect was released after his statement was recorded due to his health condition.

Reputation Risks Overshadow Arrest

Beyond the arrest itself, the larger question concerns the potential reputational fallout for the company. In modern corporate environments, perception often carries consequences as significant as a court conviction. When a chairman becomes the subject of a multibillion-ringgit investigation, reputational risk to the organisation becomes almost unavoidable.

The board of directors now faces a difficult dilemma — whether to continue backing the current leadership or take proactive steps to safeguard shareholder interests. Market history shows that investors are highly sensitive to uncertainty, particularly when it involves the most powerful figure within a corporate structure.

Although Tan Sri Krishnan Tan has not been formally charged or remanded, governance experts argue that stepping down as chairman could help prevent IJM Corp from remaining under the shadow of a RM2.5 billion money laundering investigation.

IJM Shares Under Pressure

Shares of IJM Corporation Berhad came under pressure following news of the chairman’s arrest, raising investor concerns over governance risks and the company’s reputation. At the close of trading, IJM stock fell to around RM2.73, down approximately seven sen, or 2.5%, reflecting a typical market reaction when a company’s top leadership comes under regulatory scrutiny.

While the decline cannot be attributed to a single factor, negative sentiment appears to be driven by uncertainty over leadership direction and the potential implications of the investigation on operations and institutional confidence. In a market highly sensitive to corporate integrity issues, further developments in the case are likely to influence IJM’s share performance in the near term, with investors expected to adopt a cautious wait-and-see approach.