Malaysia’s Corporate Mafia Scandal Reignites

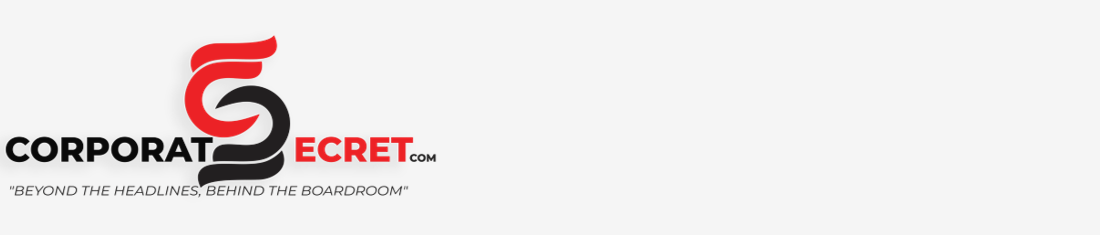

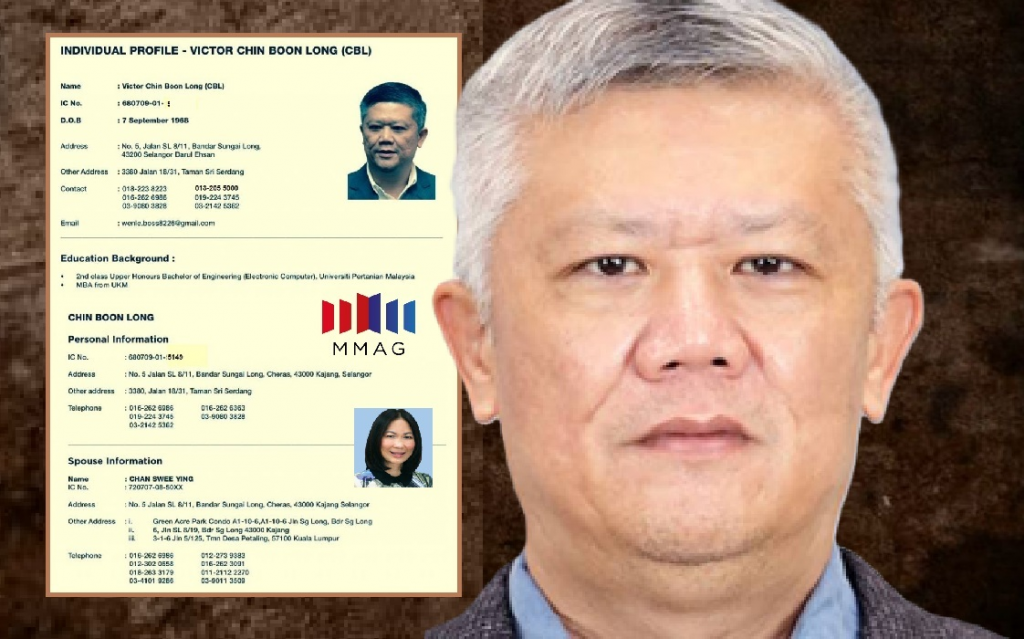

Malaysia’s corporate scene is once again in turmoil after reliable sources confirmed that Victor Chin Boon Long, widely known as Malaysia’s Corporate Mafia, is now on the run from law enforcement after fleeing abroad.

This development follows an intensified investigation into NexG Berhad and several other publicly listed companies believed to be secretly controlled by Chin through a web of proxies and financial operatives.

Francis Leong See Wui Remanded for Over 10 Days

According to sources, Francis Leong See Wui—a key lieutenant and senior adviser to Victor Chin—has been remanded for more than 10 days to assist investigations into money laundering, corporate fraud, and stock manipulation.

Leong is identified as a central figure in the hostile takeovers and internal manipulation of several Bursa-listed firms, including:

- Green Packet Bhd

- Classita Holdings Bhd (formerly Caely Holdings Bhd)

- Revenue Group Bhd

- Hong Seng Consolidated Bhd

He is also linked to the controversial multiple resale of Innov8tif Holdings Sdn Bhd, which was reportedly sold more than four times to different listed companies at excessive “markup” values—a suspected asset-inflation scheme to recycle illicit funds under the guise of corporate acquisitions.

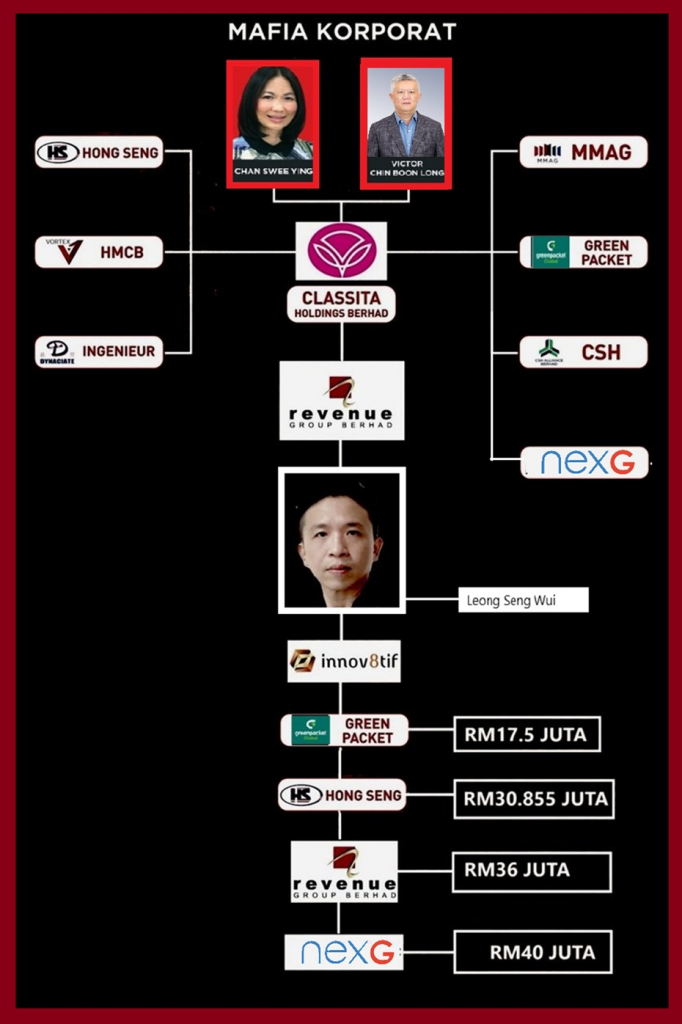

So far, a review of Bursa Malaysia filings shows no announcement regarding the 11-day remand of Francis Leong See Wui, which should have been disclosed by the public-listed companies involved.

Francis Leong See Wui serves as an Executive Director of Hong Seng Consolidated Bhd and Revenue Group Bhd, and is also the largest shareholder of South Malaysia Industries Bhd, a company he seized control of last year and which is now the subject of ongoing court proceedings.

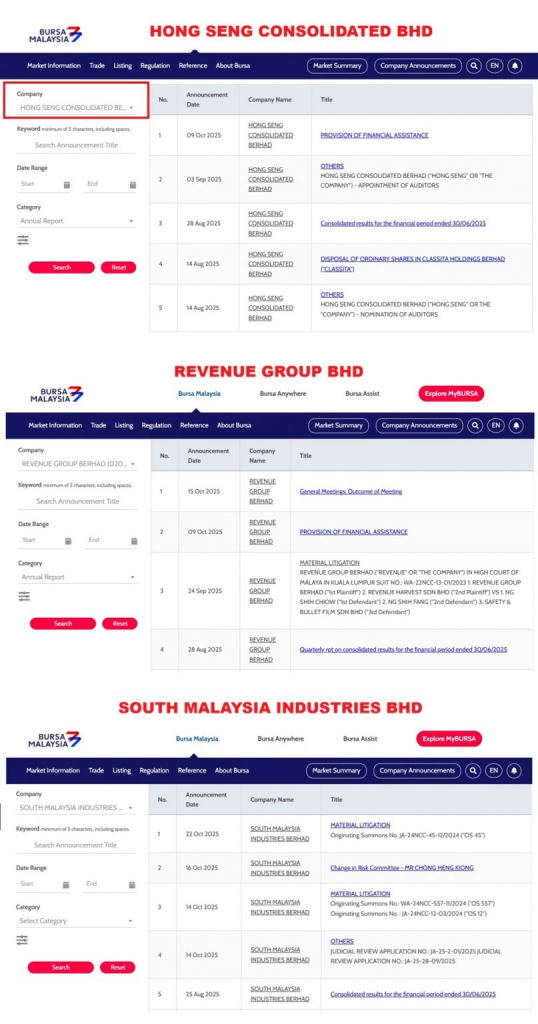

In 2023, The Corporate Secret published a forensic investigation naming Francis Leong as the principal orchestrator of RM30.7 million fund misappropriation in Classita Holdings, directly linked to Victor Chin’s network.

How Victor Chin Drained NexG Bhd with Datuk Hanifah Noordin’s Help

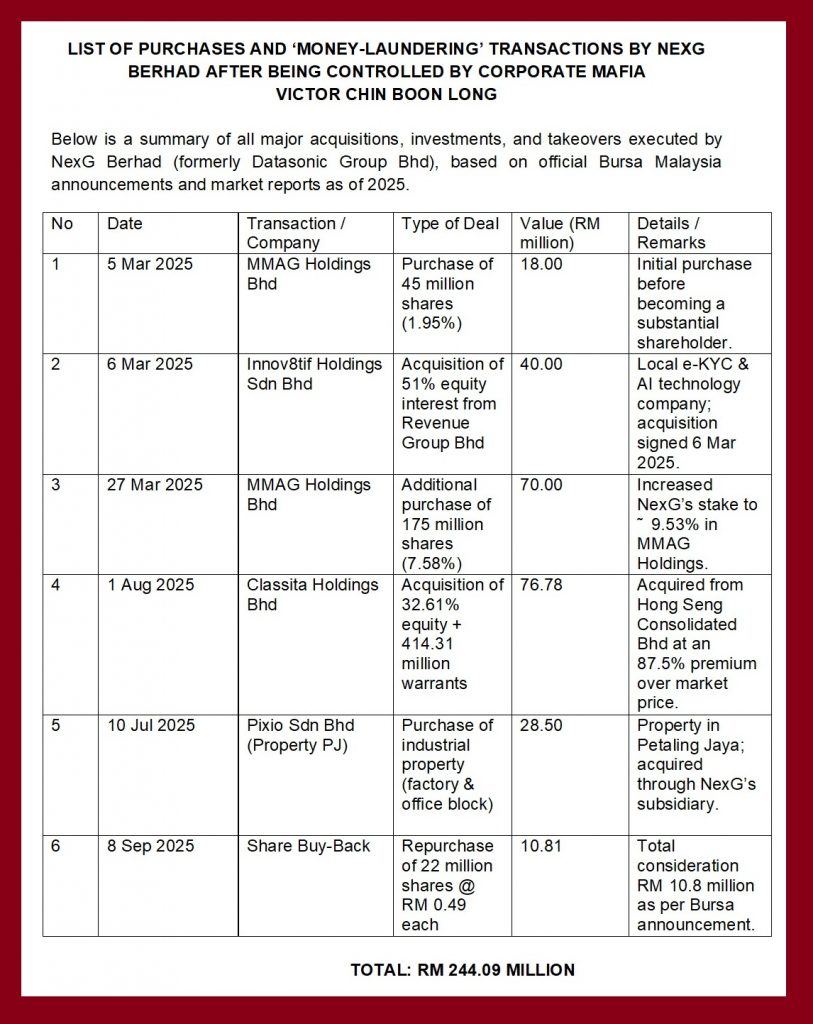

Following Chin’s takeover of NexG Berhad, he reportedly siphoned company funds through aggressive and questionable “investment” and “acquisition” exercises.

Market filings and Bursa records indicate that between March and September 2025, these deals totalled approximately RM 244 million.

Four Suspicious Transactions Identified

1. MMAG Holdings Bhd – RM 93 Million

NexG began acquiring MMAG shares as early as 5 March 2025, purchasing 45 million shares (1.95%) worth RM 18 million. Just three weeks later, on 27 March, the company added 175 million shares (7.58%) for RM 70 million, bringing its total stake to nearly 9.53%.

The purchases—executed within weeks—raised eyebrows because MMAG Holdings is also under Victor Chin and his wife Chan Swee Ying’s control, suggesting a circular ownership scheme.

2. Innov8tif Holdings Sdn Bhd – RM 40 Million

On 6 March 2025, NexG agreed to buy 51% of Innov8tif Holdings from Revenue Group Bhd for RM 40 million cash. Despite being marketed as a tech acquisition, Innov8tif’s digital-ID (e-KYC) and AI automation products had little synergy with NexG’s core business. Analysts believe the move was part of a revolving-door asset sale, where Chin’s private companies repeatedly off-loaded the same asset among listed vehicles at inflated valuations.

3. Industrial Property (Pixio Sdn Bhd, Petaling Jaya) – RM 28.5 Million

On 10 July 2025, NexG’s subsidiary acquired an industrial complex—comprising a two-storey factory, a three-storey office block, and a warehouse—from Pixio Sdn Bhd for RM 28.5 million. Pixio, owned by Singapore-listed mDR Limited, operates in the digital printing sector.

Though publicly described as a consolidation move, analysts suspect it was an attempt to convert cash into tangible assets usable as collateral or quick-sale instruments, a hallmark of high-risk financial manoeuvres.

4. Classita Holdings Bhd – RM 76.78 Million

The largest deal occurred on 1 August 2025, when NexG bought 32.61% of Classita Holdings from Hong Seng Consolidated Bhd, another Chin-linked entity. The purchase price—RM 60.31 million cash (15 sen per share)—represented an 87.5% premium over the then-market price (8 sen).

NexG also acquired 414.31 million Classita warrants for RM 16.47 million, totalling RM 76.78 million—well beyond its cash reserves (RM 61.6 million) and nearly double its short-term debt (RM 39.55 million).

Within 24 hours of the announcement, NexG’s share price plunged 31%, reflecting investor alarm over the rationale and funding sources of the deal.

Insiders allege that none of these transactions could have proceeded without the approval of Datuk Hanifah Noordin, identified as a key enabler within NexG’s internal financial chain.

The Corporate Mafia Files: Inside Victor Chin’s Secret Operations

A 2023 Corporate Secret exposé titled “Malaysia’s Corporate Mafia: Victor Chin’s Manipulation of Enforcement Agencies” had already laid bare Chin’s methods of co-opting enforcement officers and company directors to shield his empire from scrutiny.

READ THE FULL VICTOR CHIN BOON LONG FILE

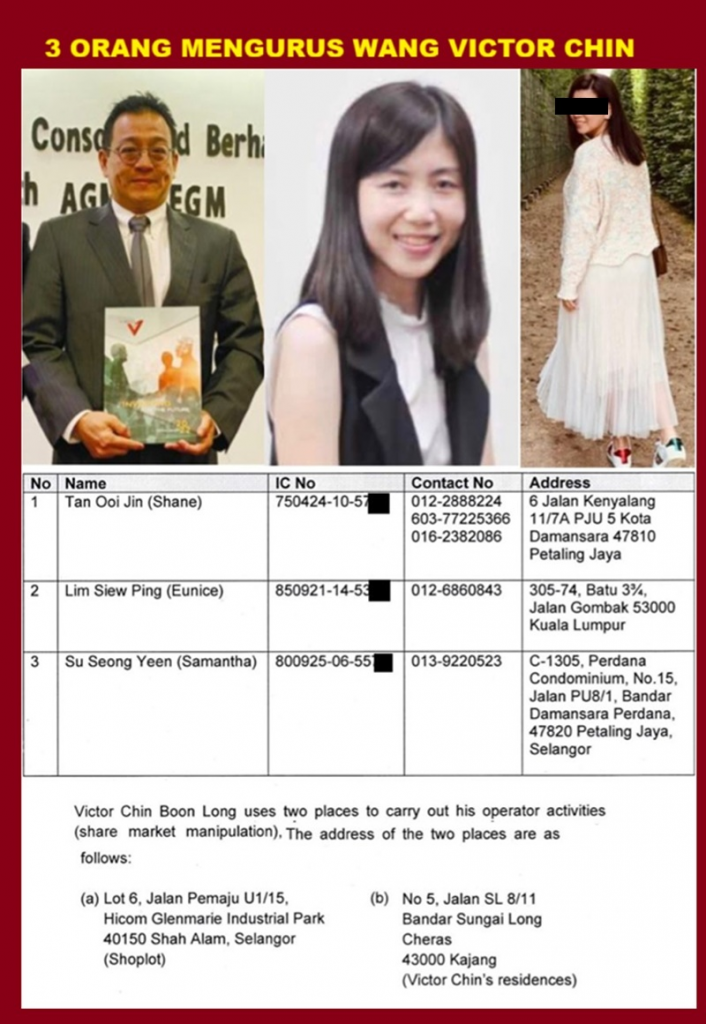

Mistress and Operative Lim Siew Ping (Eunice) Also Remanded

Also remanded was Lim Siew Ping, known as Eunice—alleged to be Chin’s second wife or mistress. She reportedly handled offshore accounts and external relations for Chin’s network. Lim previously served as a Non-Independent Non-Executive Director of MMAG Holdings Berhad until her resignation on 24 September 2019.

Sources further identified Chin’s inner circle as including:

- Tan Ooi Jin (Shane) – Chief financial controller overseeing offshore accounts;

- Su Seong Yeen (Samantha) – Investment coordinator and internal auditor within the syndicate.

First Wife Chan Swee Ying Under Enforcement Radar

To maintain corporate continuity, Chin entrusted shareholdings and directorships to his first wife Madam Chan Swee Ying, a proxy shareholder in nearly all of Chin’s listed entities.

Regulators are now believed to be investigating her for cross-shareholding transactions among Classita, NexG Bina, CSH Alliance, and Hong Seng Consolidated.

One of Malaysia’s Largest Corporate Crime Investigations

Victor Chin Boon Long is believed to have fled overseas, and investigators anticipate that, upon his capture, this case could become one of Malaysia’s largest money-laundering and corporate-fraud investigations in history.

Beyond restoring investor confidence, the probe sends a powerful message: corporate manipulation through proxies and hidden ownership cannot endure once the truth surfaces.

Too many have fallen victim to Victor Chin’s deception—and this time, the reckoning has begun.