Prosecution witnesses admit that they were trading extensively for their own gain without the Malaysian businessman’s knowledge.

SINGAPORE: Jailed businessman Soh Chee Wen fell victim to “another game in town” when the manipulation of three share counters caused the Singapore Exchange to tank 12 years ago, say his lawyers.

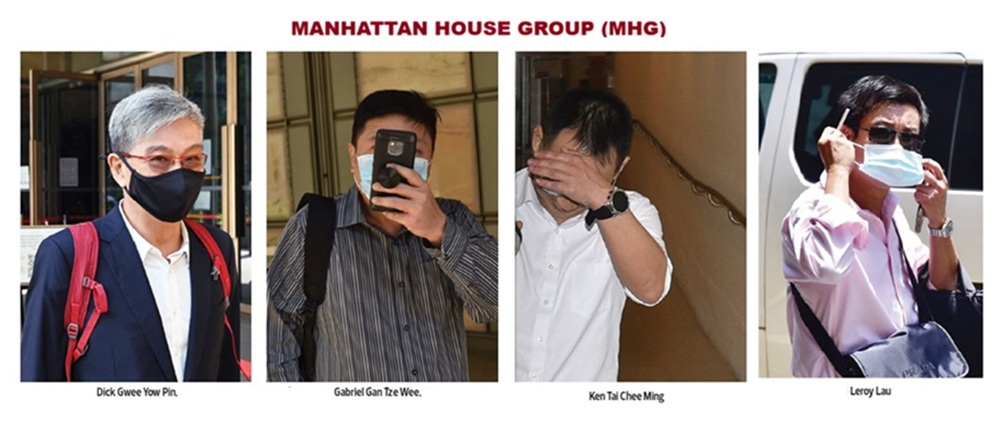

They said the High Court overlooked the “independent actions” of Soh’s former associate Dick Gwee and brokers Ken Tai, Leroy Lau, Henry Tjoa and others when convicting him and co-accused Quah Su Ling of multiple offences three years ago.

In written submissions filed in the Court of Appeal last month, defence lawyers said the prosecution’s own market expert, Professor Michael Aitken had “readily admitted” that the trading data adduced in court pointed to the existence of a side game being played without Soh’s knowledge.

They said the evidence showed that the group, known as the Manhattan House Group (MHG), was actively engaged in a pump-and-dump scheme without Soh’s knowledge.

“The prosecution simply laid all the blame at the feet of the appellants (Soh and Quah).

“They claimed that the appellants were the masterminds of a massive market manipulation scheme, using 189 trading accounts over a 13-month period,” the submissions read.

It was, they said, a “blinkered approach” to the prosecution’s case which judge Hoo Sheau Peng adopted, although it was not supported by evidence.

In his testimony, Gwee admitted to benefitting significantly from price surges generated by the group’s artificial inflation of the share prices in Blumont, Asiasons and Liongold.

“The first question is, was Gwee a principal player with respect to these trades? He has answered this himself – that he is.

“As already shown, on Sept 17, 19 and 20, 2013 alone, Gwee made S$12.8 million from dumping approximately $24 million of Asiasons, largely on those relevant accounts managed by MHG.

In the submissions, Soh’s lawyers also called Lau an “opportunistic and independent maverick trader”.

“He did communicate with the appellant. He also communicated with Gwee and he traded prolifically on his own behalf. He significantly changed his position on whether appellants directly instructed his trades,” the submissions read.

This “material change” went to root of his credibility, the lawyers said, and raises doubt on the prosecution’s case that Soh was in control of all trades.

“It is symptomatic of the prosecution’s blinkered approach that the central player in the saga, responsible for 76.2% of trade volume, turned out to be the biggest short-seller of (the shares)!”

However, Lau did not disclose his short-selling activities until confronted in cross examination at the trial, they said.

“He had to be shown that he had carried out short selling. Lau was overwhelmingly the biggest short seller (of the shares). This was clearly shown in Mr White’s expert report,” the submissions read, referring to the defence’s expert witness, David White.

MHG’s trading model and operations had allowed Gwee to load up on cheap shares and pump the share price up before proceeding to “eat-up” all of Gwee’s shares at the pumped up price, Soh’s lawyers said.

They pointed to substantial trading volume and aggressive tactics employed by MHG during the critical periods of September and October 2013. These were done often at the expense of other accounts Soh was accused of controlling, they said.

Tai also admitted to carrying out trades without instructions, Soh’s lawyers said.

Defence counsel: Do you agree that this was done for your personal benefit and not for any alleged market operations as directed by John Soh?

Tai: Yes. That, I admit.

Defence counsel: Were you running a scam, ‘yes’ or ‘no’?

Tai: Yes.

The lawyers also said that Tjoa had under cross examination recanted pre-trial statements he made to the CAD naming Soh as the person issuing instructions for all trades.

“Tai was the one mainly giving instructions,” the submissions said.

“Tjoa admitted on the stand to lying in his answers to the CAD about his connection with Tai, his assistants, and Gwee to avoid implicating them and also to avoid further implicating himself,” it added.

So, was the High Court correct in holding that the prosecution had proved beyond reasonable doubt that Soh and Quah were indeed the masterminds behind the sophisticated market manipulation scheme in 2013?

Soh’s appeal will be heard on March 3 and 4.

Soh was arrested on Nov 24, 2016.

On May 5, 2022, he and Quah were found guilty of masterminding the penny stock crash on the SGX nine years earlier through a criminal conspiracy involving forced trading, share price manipulation and deception.

Soh was sentenced to a 36-year jail term.

Quah received a 20-year jail term after being found guilty in 169 of the 178 charges she faced.