Soh Chee Wen’s lawyers tell Singapore’s Court of Appeal Gwee’s involvement was kept secret even from an officer investigating the case.

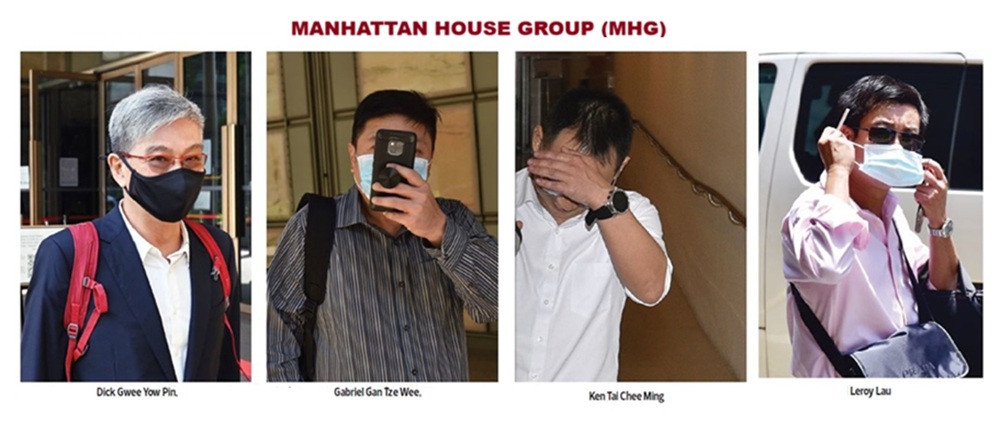

SINGAPORE: Lawyers for convicted businessman Soh Chee Wen have questioned why prosecutors downplayed Dick Gwee’s role in the infamous penny stock crash that rocked the Singapore Exchange (SGX) 12 years ago.

“The fact that the role of key third parties, such as Gwee, was not part of the prosecution’s case and had to be established by the defence makes a careful review of the evidence and the conclusions of the learned judge necessary, even though this is the appellate stage,” the lawyers said.

The remarks were contained in written submissions filed in the Court of Appeal here last month. Soh is seeking to set aside his conviction on 177 charges involving the trade of Blumont, Asiasons and Liongold shares on the Singapore Exchange (SGX).

The lawyers said Gwee, a former associate of Soh, was heavily involved in manipulating the market, but his involvement was kept secret from the defence.

Even the Commercial Affairs Department (CAD) which was investigating the case was unaware of it, they said.

“Gwee and his counsel had a meeting with the prosecution. The investigating officer (from the CAD) was not only excluded from, but had no knowledge of, the meeting and the contents of the self-recorded statement until Gwee gave evidence under cross-examination.

“Even after the meeting, no further investigation statement was recorded from Gwee. While his representations and self-recorded statement may be cloaked in privilege, there was nothing stopping the CAD from recording a statement under the Criminal Procedure Code – except for the fact that they were kept in the dark about what was going on,” the submissions read.

Soh’s lawyers said the evidence clearly showed that Gwee had “definitely operated in concert” with brokers Ken Tai, Henry Tjoa and Leroy Lau on multiple occasions.

“They traded the largest volumes, acted for their own benefit and were untruthful witnesses,” Soh’s lawyers said in their submissions.

They said Gwee was shown to have made profits of S$50 million for himself and his family members from trading in the shares.

“The prosecution’s market expert, Professor Michael Aitken, readily admitted in cross examination that the trading data showed that there could have been ‘another game in town’,” the lawyers said.

During his testimony, Gwee himself denied acting as Soh’s “lieutenant”, the submissions said.

“The evidence does not show that all transactions were ‘instructed directly’ or coordinated by the appellants (Soh and co-accused Quah Su Ling),” the lawyers noted.

Soh and Quah also said there was no evidence of a money trail between Gwee and them.

Soh’s lawyers claim that 90% of all trade activities and most of the illegitimate manipulative activities were attributed to Lau, Tjoa and Tai.

“As was shown by the defence’s cross-examination of Tai and Aitken, Gwee was clearly involved in market manipulation with Tai and Tjoa.

“Tai and Tjoa admitted to having lied to cover up for Gwee. Tai virtually admitted to falsely implicating the appellant to protect Gwee, Tjoa and himself. What from? The independent scheme that they were running,” the submissions read.

Soh’s defence team also took issue with the fact prosecutors had failed to disclose that they had obtained a “self-recorded statement” from Gwee himself and had subjected him to a six-day long interview.

“The end result is a significant procedural disadvantage to the appellant.

“It could have and should have been rectified by allowing the defence access to the self-recorded statement and to explore in cross examination what new evidence surfaced in the six days of pre-testimony interviews.

“It is now impossible to correct the prejudice caused,” the submissions read.

Soh’s appeal will be heard on March 3 and 4.

Soh was arrested on Nov 24, 2016.

On May 5, 2022, he and Quah were found guilty of masterminding the penny stock crash on the SGX nine years earlier through a criminal conspiracy involving forced trading, share price manipulation and deception.

Soh was sentenced to a 36-year jail term.

Quah was sentenced to a 20-year jail term after being found guilty in 169 of the 178 charges she faced.